Source: Oinos Educational Consulting

Source: Oinos Educational Consulting

(Part 2 of “Creating a Legacy”)

by Frank Marangos, D.Min., ED.D.

“Put your house in order, because you are going to die.”

2 Kings 20:1; Isaiah 38:1

Benjamin Franklin once said, “death takes no bribes.” In other words, when faced with imminent demise, all the money in the world is unable to buy the victim one more hour. That is . . . unless your name is Hezekiah, who apart from being one of the Old Testament kings mentioned in the genealogy of Jesus Christ, is best known for requesting that God heal his incurable disease by regressing the shadow of his royal sundial 10 steps (degrees). As a result of the unusual phenomenon (sign) that most biblical scholars attribute to a total solar eclipse, appearing to make the sun move eastward instead of westward, King Hezekiah received 15 additional years to “get his house (estate) in order” before death’s revisit (2 Kings 20; Isaiah 38; 2 Chronicles 32).

Last week, for the first time in nearly a century, millions of spectators gathered across the United States to experience a once-in-a-lifetime total eclipse of the Sun. The wondrous celestial spectacle occurred when the moon’s orbit temporarily blocked the light of the Sun from reaching the earth. Approximately two and a half minutes in duration, the solar eclipse traveled eastward across a large 67-mile wide swath of the United States at 2,400 mph. While doubtful that any contemporary eclipse chaser enjoyed the subsidy of having additional years added to the length of their respective lives, the infrequent occurrence provides savvy Americans a valuable opportunity to emulate Hezekiah by beginning “to put their house (estate) in order” before death comes seeking bribes.

Hezekiah was 37-years old when the prophet Isaiah strongly encouraged him to “get his house in order” (2 Kings 20:1). In addition to receiving a life-ending prognosis to his unknown illness, the mystic’s message came at a critical time during the young king’s reign. The Assyrians, led by a military genius named Sennacarib, had just invaded Israel. Hezekiah must have, undoubtedly, understood that his legacy would be severely jeopardized if he was prevented from leading his nation’s military response. Fortunately, thanks to his “prayerful” and “devout” attitude (Isaiah 38:2), the young ruler was given a second chance to accomplish what his unexpected illness would have certainly vexed.

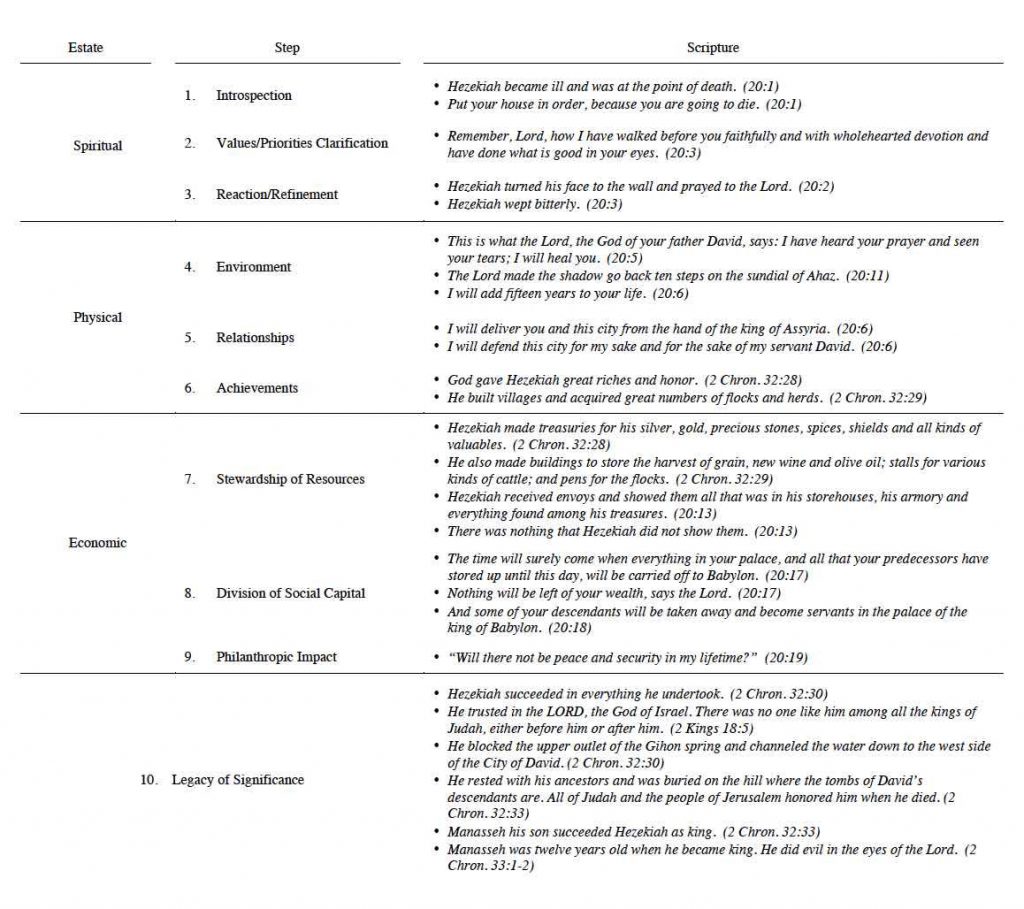

The following table outlines the process by which Hezekiah pursued the task of “putting his house (estate) in order.” Similar to the 10-degree regression of his sundial’s shadow, the 10-step methodology can be modified to accommodate any individual/family who is interested in effectively preparing their estate for their own life’s total eclipse.

Biblical Estate Planning

Ten Steps for Ordering the House

(Click to Download) A careful analysis of the scriptural account of Hezekiah’s reaction to his miraculous healing illustrates that an individual’s “house” may be understood as comprising three distinct, yet interrelated, estates: (a) spiritual, (b) physical, and (c) economic. While the spiritual estate requires continual introspection, values clarification, and refinement, the physical estate is sustained by the status of the current environment, relationships, and achievements. The economic estate, on the other hand, is determined by the stewardship of personal and social capital in search of high-level philanthropic impact. Finally, legacy is the result of the interface of these three interdepended domains in pursuit of personal significance.

A careful analysis of the scriptural account of Hezekiah’s reaction to his miraculous healing illustrates that an individual’s “house” may be understood as comprising three distinct, yet interrelated, estates: (a) spiritual, (b) physical, and (c) economic. While the spiritual estate requires continual introspection, values clarification, and refinement, the physical estate is sustained by the status of the current environment, relationships, and achievements. The economic estate, on the other hand, is determined by the stewardship of personal and social capital in search of high-level philanthropic impact. Finally, legacy is the result of the interface of these three interdepended domains in pursuit of personal significance.

The recent solar eclipse invites Americans to consider the following analysis. Have we, like Israel’s young king, made the necessary preparations, so that our families and households may enjoy physical, spiritual, and financial security after our lives have been eclipsed by death? What are we doing to make sure the “our houses are in order” – that our progeny will burgeon for generations to come? Have we demonstrated our core values and effectively articulated a path of priorities that that our family may choose to follow when we are no longer alive? Or, have we – like the majority of contemporary Americans – failed to adequately prepare for life’s ultimate eclipse?

Survey data, regrettably, indicates that less than half of the nation’s population is adequately focused on getting their respective homes (estates) “in order.” According to the Wills & Estate Planning Survey conducted by Lawyers.com, the percentage of Americans possessing estate planning documents such as wills, trusts and/or power of attorney has dropped considerably over the last decade. In addition, while most individuals are the wealthiest at the point of their death, the 2016 Gallup Poll supports the conclusions of the previous year’s Harris Poll Estate-Planning Survey (2015) that only 44% of Americans say they have a will. As a result, due to conflicts over asset distribution and improperly prepared or updated estate plans, nearly one-in-five (20%) Americans claim to have personally experienced problems after the death or incapacitation of a loved one.

According to the Wealth-X and National Financial Partners Wealth Transfers Report, more than $12 trillion in financial and non-financial assets is currently being shifted from the Greatest Generation (1920-1930) to Baby Boomers (1946-1964). Over the next 30 to 40 years, an additional $30 trillion in financial and non-financial assets will pass from Boomers to their heirs in North America alone. At the peak, between 2031 and 2045, 10% of total wealth in the United States will change hands every five years, making it the largest generational wealth transfer in history.

The aforementioned data underscores the value of the Prophet Isaiah’s exhortation of putting one’s “house in order.” In their USA Today article entitled, “5 Tips To Help Get Your Financial House In Order,” monetary experts Matt Krantz, John Waggoner and Rodney Brooks, outline the need to: (a) retire debt, (b) refinance mortgage, (c) recharge your savings, (d) readjust investment portfolio, and (e) hire a financial planner. While informative, the essay unfortunately omits that, apart from a careful evaluation of an individual/family’s net-worth statement, the most important component of a “well-ordered” estate is an honest examination of core values, priorities, and life goals in pursuit of a legacy of significance.

In their primer on financial planning, Getting Your Financial House in Order, OppenheimerFunds Services provides a step-by-step guide for crafting a well-defined plan. While providing useful worksheets concerning net-worth, cash flow, college planning, investment goals, retirement, and ongoing plan monitoring, the authors fail to adequately discuss the issue of legacy goals, values and priorities. Unfortunately, like Krantz, Waggoner, and Brooks, the topic of high-impact charitable contributions is never mentioned as a vital element of the well-ordered financial house (estate).

In contrast to more traditional financial methodologies, core principles, life dreams, special family requirements, and philanthropic aspirations are what drive the more values-driven, and donor-centered estate planning approaches. According to the 2016 U.S. Trust Study of High Net Worth Philanthropy Report published by the Bank of America Corporation, the primary reason high net-worth individuals make philanthropic gifts is because they believe in the mission of charitable organizations (54%). Nearly half (44%) of the survey respondents claim that they give when they believe their gift can make a substantive difference, while 39% plan financial gifts for personal satisfaction, enjoyment, or fulfillment.

In addition, 45% of high net worth donors report that charitable giving has the most potential to generate social impact as compared to other activities. Consequently, rather than focus on planning approaches that rely on inventive financial tools, clever tax-avoidance strategies, or the hottest pecuniary products, data overwhelmingly indicates that over 90% of the time, values-driven estate counseling increases (a) personal confidence, (b) the likelihood of plan execution, and (c) the allocation of major differed charitable gifts. The data overwhelmingly supports the need for more personalized financial planning counseling.

Dr. Eddie Thompson, founder and CEO of Thompson and Associates, identifies the prime objective of donor-centered charitable estate planning (CEP) as “the honest desire to assist individuals/families in answering three big questions: (a) How much will my spouse and I need to live the rest of our lives? (b) What can or should we pass on to our heirs and when? and (c) Would we rather leave a part of our estate to our favorite charities or to the IRS?” Simply offering a financial tool as a single uncoordinated step without intimate knowledge of an individual’s core values, life priorities, and financial situation is unlikely to be the optimum choice for putting one’s “house in order.” Thompson humorously suggests that trying to do so “would be like trying to hit a flying duck by throwing a rock blindfolded — shear accident.”

Apart from providing a valuable method for navigating the aforementioned great wealth transfer, King Hezekiah’s ten-step “house ordering” process is a wonderful complement to Thompson’s three-tier estate planning concerns. In order to genuinely determine what an individual/couple needs to comfortably live out the rest of their lives, a personalized confidential review, analysis, and clarification of life values (spiritual estate) must first be undertaken. Only when environmental conditions, relationships, and achievements (physical estate) are subsequently identified can strategic options for determining the division of social capital (economic estate) between the government, and/or charitable entities, be identified and prudently chosen.

The wisdom of past generations emphasized that a chief purpose of life was the facilitation of a “good death.” In fact, Seneca, the famous Roman Senator and philosopher, once said that it takes “all of life to learn how to die.” Regrettably, postmodernity promises the illusion that death can, indeed, be cheated through cosmetic surgery, exotic herbs, medical devices, genetic manipulation, and – above all – robust investment portfolios.

Hezekiah’s unexpected sickness illustrates the ideological delusions associated with such self-deterministic belvederes. Apart from his religious and military obligations to the nation of Israel, perhaps the most important issue that concerned the young king was his estate’s line of succession. At that time in his life, Hezekiah did not have a direct heir. Commentators consequently suggest that Hezekiah was reluctantly planning to bequeath his kingdom to another sovereign that was not of his genealogical heritage. His son Manassah, who eventually was enthroned as king, was not born until three or four years after the miraculous healing of Hezekiah’s illness. Unfortunately, the legacy of Manasseh did not match the prestige of his father, but characterized by Holy Scripture as one of Israel’s most evil and vile administrations (2 Chronicles 33:9).

In the ancient Hellenic world “oikonomos” was the title given to an individual responsible for the administration of a last will and testament. According to Strongs Exhaustive Concordance, the Greek word is a composite of “oikos” (home) and “nomos” (rule, law) and often translated as “steward.” The word was used to denote a house-manager (overseer, superintendent). By extension, an employee in the same capacity was understood to be a fiscal agent or trustee (treasurer, chamberlain, governor). This rather strange compound word gave rise to the modern term “economy” and the whole range of related phrases.

Hezekiah was a wise leader who linked human knowledge with the intimate counsel of God. With few exceptions, modern day leaders would do well to emulate his performance. Unfortunately, apart from failing to nurture humility and a God-fearing attitude in his son, Hezekiah was not a good “oikonomos” of his nation’s financial estate. When the King of Babylon saw the astrological sign of his miraculous healing, he subsequently sent ambassadors to inquire concerning “the wonder that was done in the land” (2 Chron. 32:31). Rather than modestly focus on the subsidies bestowed upon him and his nation by God, Hezekiah foolishly showed them everything, from his treasures to his defenses – as if they were the corollaries of his own strength, wisdom, and abilities. As a result of his arrogance, the prophet Isaiah prophesied that although Hezekiah would have peace in his day, his nation’s entire estate would one day belong to the Babylonians.

The word legacy is frequently used to describe the property that people leave their heirs when they die. Apart from financial assets, however, every human being also bequeaths a nonmaterial legacy, one that is more difficult to define, but often of far greater importance. Such a legacy is comprised of a lifetime of relationships, accomplishments, truths, and values that will be transferred to future generations.

Wealth is, consequently, an extension of our physical and spiritual legacy. It’s a tangible expression of our mind, heart, and labor. Our wealth is the fruit of the way we have invested our lives. In contrast to popular opinion, everyone, regardless of wealth, is the “oikonomos” of their respective legacy. The only issue is whether we, or the government, will ultimately steward our lives’ congealed efforts. Like King Hezekiah, if we have not taken the time/effort to “put our homes in order” according to our needs, desires, and life priorities, another entity will, unfortunately, decide how and to whom our resources will be allotted.

For over five years an ancient clay seal remained unexamined in a dusty closet of the Jerusalem Institute of Archeology. The 3,000-year-old object was discovered during an excavation at the foot of the southern part of Jerusalem’s old city wall. Fortunately, after carefully scrutinizing the letters on the seal, a major discovery was announced. The inscription, written in ancient Hebrew reads, “Belonging to Hezekiah [son of]Ahaz King of Judah.” At the center of the seal, researchers discovered the impression of a two-winged icon of the sun surrounded by two images symbolizing life. Archeologists are convinced that the priceless artifact belonged to King Hezekiah who began using the seal as the nation of Israel’s symbol of divine protection after God miraculously healed him of his life-threatening illness.

A solar eclipse is a remarkable cosmic event that occurs when the Moon obscures the Sun. Although both planets appear to be about the same size during an eclipse, the Sun is actually 400 times larger than the moon in diameter. Alternatively, a lunar eclipse occurs when the moon becomes totally dark as a result of the earth coming between the Sun that it usually reflects. A total life eclipse, on the other hand, occurs when death’s orbit appears to extinguish the light of an individual’s legacy (spiritual, physical and economic estate) from reaching our progeny.

According to the U. S. Census Bureau, more than 2.5 million Americans (mostly seniors) die each year. Due to an aging baby boom population, the number of deaths is expected to increase dramatically over the next 10 to 20 years. When the figure is combined with the estimated 55% of Americans who do not have an estate plan or a simple will, it becomes clear that an alarming number of people will die intestate over the next 20 years.

Leo Tolstoy once said, “We can be lord of nothing as long as we fear death. When we no longer fear it, all things are ours.” Tolstoy is right. When we live as faithful stewards of what has been entrusted to our care, death itself loses its terror. Fortunately, the prudent can effectively face humanity’s universal eclipse by calmly responding to the prophet Isaiah’s admonition to put our spiritual, physical, and economic estates in order.